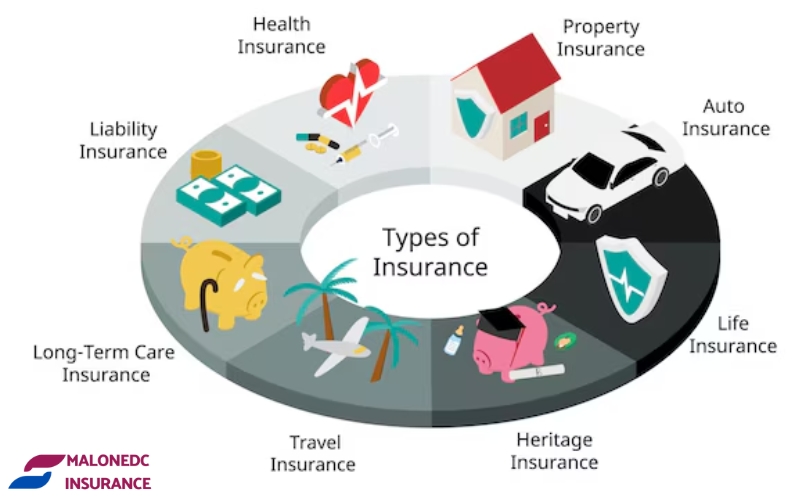

These types of insurance not only protect your health and personal assets, but also help you maintain financial stability in the event of an unfortunate incident with your career or job. Especially for those with loans, professional insurance can play a key role in ensuring debt repayment and protecting your family’s financial future. This article will explore in detail the types of professional insurance and their relationship to loan management.

1. WHAT IS PROFESSIONAL INSURANCE?

Occupational insurance is insurance products specifically designed to protect workers, especially those in risky occupations or jobs that require good health to maintain the ability to work. This type of insurance can include work accident insurances, loss of income insurance due to illness, or unemployment insurance. For borrowers in particular, occupational insurance is an important tool to minimize financial risks, ensuring that you can maintain the ability to repay your debts even if your job or income is interrupted.

2. COMMON TYPES OF OCCUPATIONAL INSURANCE

There are many different types of occupational insurance, each of which can support you in different situations. Below are common types of occupational insurances and how they can help you protect your personal finances, especially when it comes to loans.

Workers’ Compensation Insurance: This type of insurance provides financial protection in the event of an accident at work. Depending on the severity of the accident, this insurances will cover some or all of the cost of treatment, helping to ease your financial burden. Especially if you have a loan, workers’ compensation insurances helps you avoid having to use the loan to cover the cost of treatment or losing income while recovering.

Disability Income Insurance: This type of insurance helps you maintain your income in the event of illness, disease or being unable to work for a long period of time. If you have a loan, this insurances will provide a monthly benefit, helping you maintain your ability to repay the loan and protect your family’s finances while you are unable to work.

Unemployment insurance: In the event that you lose your job due to layoffs or other reasons beyond your control, unemployment insurances provides benefits to help you cover your basic living expenses while you look for a new job. This is especially important if you have loans, as unemployment insurance helps protect you financially and avoid defaulting on your loans while you are unemployed.

Income protection insurances: This insurances helps you maintain your income in the event that you are unable to work due to health or accident. When you participate in income protection insurances, you will receive a monthly benefit, helping you cover your living expenses and maintain your ability to repay your loans in the event that you are unable to work for an extended period of time.

3. THE RELATIONSHIP BETWEEN PROFESSIONAL INSURANCE AND LOANS

For those who have loans, taking out professional insurances is a smart financial strategy to protect their ability to repay their debts. The relationship between professional insurance and loans can be explained through the following points:

Maintain your ability to repay your debt: When you have a loan, especially a large loan such as a home loan or a car loan, your ability to repay your debt depends on a stable income. If you encounter problems at work, such as a work accident, illness, or job loss, occupational insurance will help you maintain your income. This helps you not to have an interruption in your debt repayment and protects your family’s finances.

Minimize financial risks when you have a professional problem: In case you cannot work due to illness or accident, occupational insurances helps you reduce financial pressure. You will not have to worry about a lack of income and not being able to repay your loans on time. The benefits from the insurances will help you cover your living expenses and protect your financial stability.

Protect your assets and family: When you have large loans, protecting your assets from financial risks is extremely important. Occupational insurances helps you protect your personal assets, while minimizing the risk of having to sell assets or cut back on spending to pay off debts in the event of a work accident.

Increased financial peace of mind: Having occupational insurances helps you feel more secure when taking out loans. You will not have to worry about not being able to repay the loan if you encounter unexpected problems at work. Occupational insurances helps you protect both yourself and your family, while maintaining financial stability throughout the loan period.

4. NOTES WHEN CHOOSING OCCUPATIONAL INSURANCE WHEN HAVING LOANS

When you decide to participate in occupational insurance and you have a loan, there are some important factors to keep in mind to ensure that you choose the right insurances package:

Assess the level of protection needed: Depending on your job and health situation, choose the type of insurance that suits your needs. If your job has a high risk of accidents, workers’ compensation insurances may be a good option. If you have a desk job, disability or unemployment insurance may be a better option.

Check the terms and conditions: Before taking out insurance, read the terms and conditions and benefits carefully. Make sure the insurance plan you choose will cover the full range of benefits you would need in the event of a work-related accident.

Choose insurances with additional benefits: Some occupational insurance plans may include additional benefits such as long-term income protection or protection for your family in the event you are unable to work long-term. Look for plans that offer a full range of benefits to protect you and your family financially in the event of a loan.

CONCLUSION

Occupational insurance is an important financial tool to help you protect your health and personal finances, especially when you have loans. By participating in occupational insurances, you can maintain your ability to pay debts throughout the loan period, minimize financial risks when encountering occupational incidents and protect your assets. When choosing occupational insurances, pay attention to choosing insurances packages that suit your needs and working conditions to ensure that you are always fully protected.